info-gacor.site

Gainers & Losers

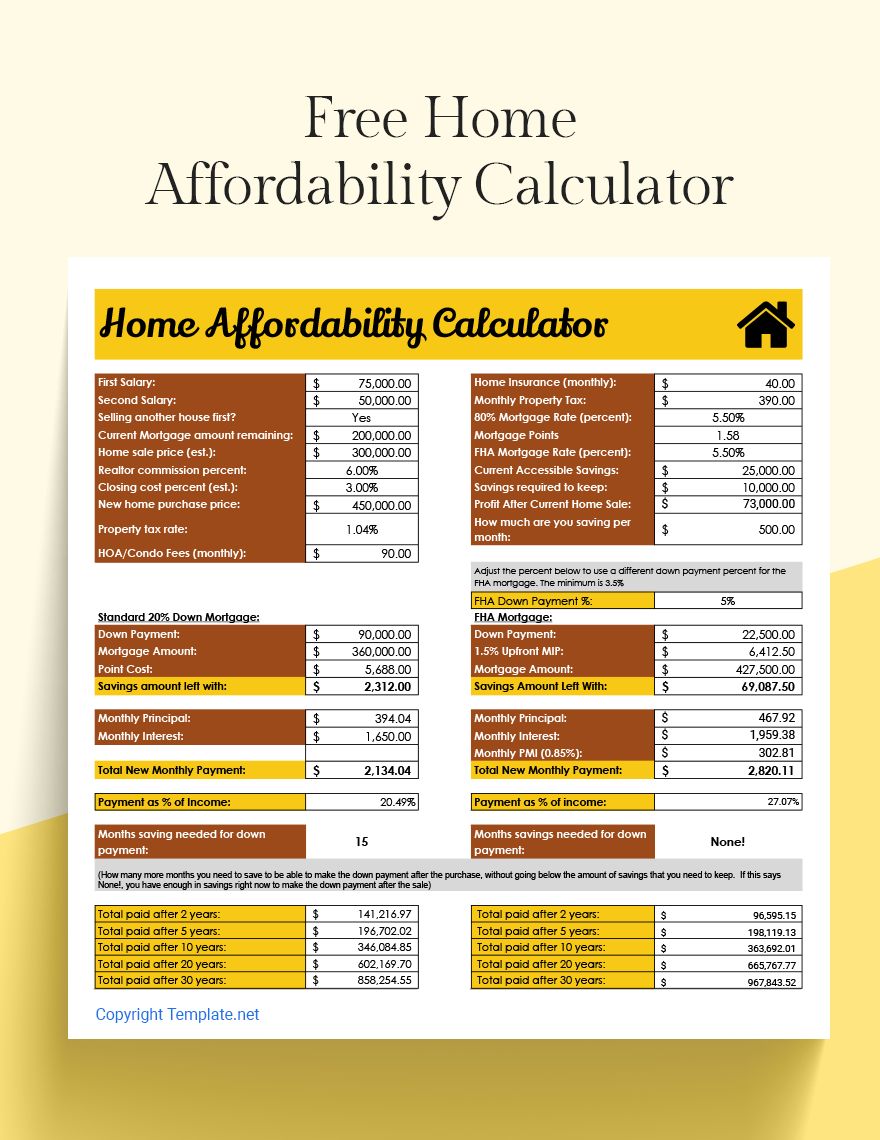

Mortgage Affordability Calculator First Time Home Buyer

Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. Mortgage calculator. Looking to calculate payments on a new home loan? Use our delightfully easy mortgage calculator. Get Estimates. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Explore more mortgage calculators How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home. 28% Housing Expenses - This rule suggests that your monthly housing expenses, which include mortgage payments, property taxes, homeowner's insurance, and. Enter your info to find out how much you can afford! Mortgage information. First time homebuyer? Use this calculator to estimate how much house you can afford with your budget. Calculate your affordability Note: Calculators display default values. Enter new figures to override. Gross Income. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. Mortgage calculator. Looking to calculate payments on a new home loan? Use our delightfully easy mortgage calculator. Get Estimates. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Explore more mortgage calculators How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home. 28% Housing Expenses - This rule suggests that your monthly housing expenses, which include mortgage payments, property taxes, homeowner's insurance, and. Enter your info to find out how much you can afford! Mortgage information. First time homebuyer? Use this calculator to estimate how much house you can afford with your budget. Calculate your affordability Note: Calculators display default values. Enter new figures to override. Gross Income. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget.

Illustration: A purple home in the background with a large green key in the foreground. Help for the first-time homebuyer. Gain insight into what all you should. Improving mortgage affordability if you're a first-time home buyer. If you're plotting out your first home purchase and are worried about how much house you can. Wondering how much house you can afford? Try our home affordability calculator to help estimate what you may qualify for and your monthly payment. Find out how much house you may be able to afford today based on your current budget and monthly expenses. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Use the LendingTree home affordability calculator to help you analyze multiple scenarios and mortgage types to find out how much house you can afford. How much mortgage can you afford? Check out our simple mortgage affordability calculator to find out and get closer to your new home. For example, a year fixed mortgage would have payments (30x12=). This formula can help you crunch the numbers to see how much house you can afford. Your estimated annual homeowner's insurance amount for your new home. Home-purchase affordability depends on various factors and is not guaranteed. Thinking about how much house can I afford? Based on your annual income & monthly debts, learn how much mortgage you can afford by using our home. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. Home Affordability Calculator. We're here to help: Apply Follow these steps on how to buy your first home and see first time home buyer loan options. mortgage, homeowners insurance and property taxes, should never add up to more than 36% of your gross income (i.e. your pre-tax income). While buying a new home. Enter your info to find out how much you can afford! Mortgage information. First time homebuyer? How the FHSA helps first-time home buyers. Get closer to home ownership with the First Home Savings Account (FHSA). Learn how to save for your first home, tax-. This mortgage payment calculator will help you find the cost of homeownership at today's mortgage rates, accounting for principal, interest, taxes, homeowners. It's ideal for first-time home buyers who lack the money for a large down payment. VA loans:Current and former members of the U.S. military (and qualifying. Find out how much home you could afford and estimate what your monthly mortgage payment could be. The first step in buying a house is determining your budget. First Time Homebuyer? Make Sure You're Prepared For These 7 Hidden Costs. When budgeting for your first home, here are seven often overlooked costs that can.