info-gacor.site

News

Lost W2 From Previous Years

Call () or go to Get Transcript by Mail. Transcripts will arrive in about 10 days. 3. Use IRS Get Transcript. Set up an IRS account and download. There is an $ processing fee per tax year requested. If you are currently employed with the university‚ you must pay for your duplicate W-2 via payroll. You can download a copy from Cal Employee Connect under the "W-2" tab. You also can request one from the State Controller's Office. A prior year W-2 if your current W-2 is not available. If you worked for the same employer and can confirm that your pay and deductions remained the same. Name · Employee Identification Number · Last 4 digits of your Social Security Number · A daytime telephone number where you can be reached · Year(s) duplicate W Also, form W-2s for years – are available on CIS. If you are a current employee that opted for a printed W-2, and didn't receive or lost your printed. File for an extension: a six-month extension will give you more time to recover the missing W Get a copy of your transcript from the IRS. Many times your. If you still do not receive your W-2 by February 15th, you can contact the IRS at info-gacor.site or call Wage and income transcripts are available from the IRS free of charge. They're not exact copies, but they contain everything on your W-2, except the state and. Call () or go to Get Transcript by Mail. Transcripts will arrive in about 10 days. 3. Use IRS Get Transcript. Set up an IRS account and download. There is an $ processing fee per tax year requested. If you are currently employed with the university‚ you must pay for your duplicate W-2 via payroll. You can download a copy from Cal Employee Connect under the "W-2" tab. You also can request one from the State Controller's Office. A prior year W-2 if your current W-2 is not available. If you worked for the same employer and can confirm that your pay and deductions remained the same. Name · Employee Identification Number · Last 4 digits of your Social Security Number · A daytime telephone number where you can be reached · Year(s) duplicate W Also, form W-2s for years – are available on CIS. If you are a current employee that opted for a printed W-2, and didn't receive or lost your printed. File for an extension: a six-month extension will give you more time to recover the missing W Get a copy of your transcript from the IRS. Many times your. If you still do not receive your W-2 by February 15th, you can contact the IRS at info-gacor.site or call Wage and income transcripts are available from the IRS free of charge. They're not exact copies, but they contain everything on your W-2, except the state and.

If your W-2 Form is not legible or if you have lost it, contact your employer and request another. If you have not received your W-2 Form, and it is after. Requests for older tax records may take longer to process. Note: We will W-2). Requests from Taxpayer's Legal Guardian. Provide a certified copy of. You can request your prior year's return online. Signing up for an account is quick and easy. You can request prior returns through mail. Your employer is required to issue a wage and tax statement, Form W-2, by January 31st if you earned wages during the previous calendar year. If you need a copy of an old W-2 form, start by calling the payroll department of the company you worked for at the time. If you can't contact the company, call. W-2 forms show the income you earned the previous year and what taxes were withheld. Learn how to replace incorrect, stolen, or lost W-2s or how to file one if. Log in to Paychex Flex. Under Tax Documents, click the PDF icon to download your W-2 or Employers are required to issue W-2 forms to employees no later than January 31 following the close of the calendar year. Missing & Exploited Children. W-2 Statements. When filing a paper return, all W-2s and/or s that previous year. The form is in postcard format. A separate copy of your OSUP advises agencies in January via an OSUP memorandum when duplicate request forms will be accepted for the previous tax calendar year. Active Employees. Request a wage and transcript statement from the IRS. If your employer uses Quickbooks, and you are using Turbotax, your W-2 may be available. Requests for copies of your W-2(s) must be made to your employer. If your employer is unable to provide a copy, you will need to request a substitute income. To request a W-2 from a previous employer, contact their Human Resources or Payroll department. Provide your full name, Social Security Number, and the year. You can view and print a prior year's W-2 in myPay. If you are separated and no longer have access to myPay, you may submit a Request for Duplicate, Corrected. File a Form X On occasion, you may receive your missing W-2 after you filed your return using Form , and the information may be different from what you. You can request prior years tax return transcripts and W2 forms from the IRS website. The easiest way however is to request them from your prior. Reissued W-2 and/or S, and/or C (Duplicate Copy) - Reissues or duplicates of the tax statements can be retrieved electronically up to 7 years back. To request a W-2 from a previous employer, contact their Human Resources or Payroll department. Provide your full name, Social Security Number, and the year. If an individual did not receive a W-2 from an employer, that person should contact the IRS at for further instructions. Individuals who lose a W Call the IRS and request wage and income transcripts for up to six years prior, for no charge. You can call an EA like me to get them as well.

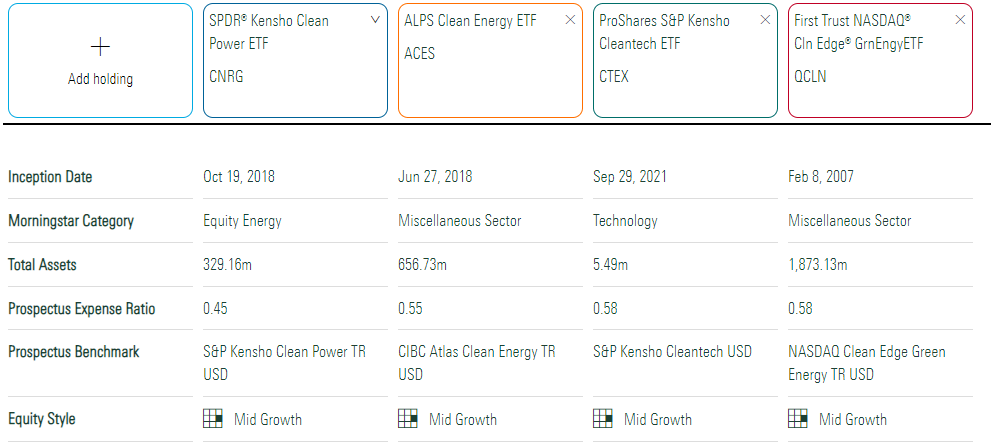

Qcln Etf Holdings

First Trust Nasdaq Clean Edge Green Energy ETF (the "First Trust ETF Number of Holdings. $8,,, ,, 1. Top Holding (as at )5. Latest First Trust NASDAQ Clean Edge Green Energy Idx Fd (QCLN) stock price, holdings, dividend yield, charts and performance ETF's current and past N. Top 10 Holdings ; Enphase Energy Inc. ENPH, % ; Albemarle Corp. ALB, % ; Rivian Automotive Inc. Cl A, RIVN, % ; Universal Display Corp. OLED, %. The QCLN Exchange Traded Fund (ETF) is provided by First Trust. It is built to track an index: NASDAQ Clean Edge Green Energy Index. The QCLN ETF provides. Navigate Tax Plans With Strategic ETF Investments. 07/22/PM EST Zacks ; Trump Trade Gaining Momentum: ETFs in Focus. 07/15/PM EST Zacks ; QCLN. Top 10 Holdings ; Tesla Inc TSLA, - ; First Solar Inc FSLR, - ; ON Semiconductor Corp. ON, - ; Enphase Energy Inc ENPH, -. Learn everything about First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN). News, analyses, holdings, benchmarks, and quotes. QCLN | A complete First Trust NASDAQ Clean Edge Green Energy Index Fund exchange traded fund overview by MarketWatch. View the latest ETF prices and news. Find the latest First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) stock quote, history, news and other vital information to help you with your. First Trust Nasdaq Clean Edge Green Energy ETF (the "First Trust ETF Number of Holdings. $8,,, ,, 1. Top Holding (as at )5. Latest First Trust NASDAQ Clean Edge Green Energy Idx Fd (QCLN) stock price, holdings, dividend yield, charts and performance ETF's current and past N. Top 10 Holdings ; Enphase Energy Inc. ENPH, % ; Albemarle Corp. ALB, % ; Rivian Automotive Inc. Cl A, RIVN, % ; Universal Display Corp. OLED, %. The QCLN Exchange Traded Fund (ETF) is provided by First Trust. It is built to track an index: NASDAQ Clean Edge Green Energy Index. The QCLN ETF provides. Navigate Tax Plans With Strategic ETF Investments. 07/22/PM EST Zacks ; Trump Trade Gaining Momentum: ETFs in Focus. 07/15/PM EST Zacks ; QCLN. Top 10 Holdings ; Tesla Inc TSLA, - ; First Solar Inc FSLR, - ; ON Semiconductor Corp. ON, - ; Enphase Energy Inc ENPH, -. Learn everything about First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN). News, analyses, holdings, benchmarks, and quotes. QCLN | A complete First Trust NASDAQ Clean Edge Green Energy Index Fund exchange traded fund overview by MarketWatch. View the latest ETF prices and news. Find the latest First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) stock quote, history, news and other vital information to help you with your.

ETFs Holding QCLN ; ; %. Top 10 Holdings · Enphase Energy, Inc% · MUTUAL FUND (OTHER)% · First Solar, Inc% · Consolidated Edison, Inc% · Iberdrola SA% · Vestas Wind. Top 10 Holdings · Goldman Sachs Financial Square Treasury Obligations Fund % · Tesla Inc % · ON Semiconductor Corp % · First Solar Inc % · Enphase. The QCLN Exchange Traded Fund (ETF) is provided by First Trust. It is built to track an index: NASDAQ Clean Edge Green Energy Index. The QCLN ETF provides. A list of holdings for QCLN (First Trust Nasdaq Clean Edge Green Energy Index Fund) with details about each stock and its percentage weighting in the ETF. First Trust Global Funds plc Nasdaq Clean Edge Green Energy UCITS ETF (QCLN) ; Securities lending: No ; Number of holdings: 60 ; Size: $M ; Launch date: ETF information about First Trust NASDAQ Clean Edge Green Energy Index Fund, symbol QCLN, and other ETFs, from ETF Channel QCLN — Top Stock Holdings. First Trust NASDAQ® Clean Edge® Green Energy Index Fund QCLN:NASDAQ as of 08/28/ Holdings are subject to change. Schwab ETF Holdings. Top 5 holdings ; ON Semiconductor Corp ON:NSQ, %, % ; Enphase Energy Inc ENPH:NMQ, %, %. Find the latest quotes for First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) as well as ETF details, charts and news at info-gacor.site Top 10 Holdings as of 08/29/ ; ALB, Albemarle Corp. % ; LCID, Lucid Group Inc Shs. % ; OLED, Universal Display Corp. % ; AYI, Acuity Brands Inc. %. QCLN: First Trust NASDAQ Clean Edge Green Energy Index Fund - Fund Holdings. Get up to date fund holdings for First Trust NASDAQ Clean Edge Green Energy. Holdings ; ON Semiconductor Corp, , Feb 28, ; Enphase Energy Inc, , Mar 18, ; First Solar Inc, , Mar 31, ; Rivian Automotive Inc Class A. Top 10 Holdings ; ON Semiconductor. % ; Enphase Energy. % ; First Solar. % ; Rivian Automotive. % ; Albemarle Corp. %. QCLN ETF Chart & Stats · First Trust Nasdaq Clean Edge Green Energy Index Fund (QCLN) Fund Flow Chart · QCLN ETF Smart Score · Top 10 Holdings · QCLN ETF News · QCLN. QCLN ETF FAQ What are ETF QCLN's top 3 holdings? What is ETF QCLN's holdings count? What are the total assets of ETF QCLN? ETF QCLN's total assets are. First Trust NASDAQ® Clean Edge® Green Energy Index Fund QCLN has $ MILLION invested in fossil fuels, % of the fund. But (k)s have big holdings. QCLN ETF Profile ; Albemarle Corporation, ALB, % ; Universal Display Corporation, OLED, % ; Lucid Group Inc. (Class A), LCID, % ; Acuity Brands. QCLN Holdings Summary As Of Aug ; ENPH, %, % ; FSLR, %, % ; RIVN, %, % ; ALB, %, %. Top 10 Holdings ; ON Semiconductor Corporation, ON, % ; Enphase Energy, Inc. ENPH, % ; First Solar, Inc. FSLR, % ; Rivian Automotive, Inc. RIVN, %.

How To Buy Ripple Shares

Ripple stock is not currently traded in the private markets. We do not have enough data to print a price history for Ripple right now. If you can share any. The price of Ripple is $ You can watch XRP and buy and sell other cryptocurrencies, stock and options commission-free on Robinhood. You can buy XRP on several exchanges, such as Bitstamp, Kraken, Huobi Global, and Coinbase. XRP is a cryptocurrency that can be used as a payment method or. The best place to buy XRP is on a crypto exchange like Cointree. A crypto exchange is much like a stock exchange or similar financial institutions, but is. 1. Open an account with Kraken – · 2. Identity verification – · 3. Deposit – · 4. Buy XRP –. It means, you can use it as an investment or to buy something. You can also exchange XRP with other currencies, the process should be done on the Ripple network. Buy or sell Ripple stockLearn more about Ripple IPO. Register To Buy and Sell Shares. For more details on private stock price information, financing and. If you are interested in purchasing XRP or investing in Ripple, you will need to use a cryptocurrency exchange or trading platform such as eToro. Here. I have never bought any Ripple shares, but you can buy them on Linqto. There is a minimum spend, not sure what it is ($5k? $10k). And unless. Ripple stock is not currently traded in the private markets. We do not have enough data to print a price history for Ripple right now. If you can share any. The price of Ripple is $ You can watch XRP and buy and sell other cryptocurrencies, stock and options commission-free on Robinhood. You can buy XRP on several exchanges, such as Bitstamp, Kraken, Huobi Global, and Coinbase. XRP is a cryptocurrency that can be used as a payment method or. The best place to buy XRP is on a crypto exchange like Cointree. A crypto exchange is much like a stock exchange or similar financial institutions, but is. 1. Open an account with Kraken – · 2. Identity verification – · 3. Deposit – · 4. Buy XRP –. It means, you can use it as an investment or to buy something. You can also exchange XRP with other currencies, the process should be done on the Ripple network. Buy or sell Ripple stockLearn more about Ripple IPO. Register To Buy and Sell Shares. For more details on private stock price information, financing and. If you are interested in purchasing XRP or investing in Ripple, you will need to use a cryptocurrency exchange or trading platform such as eToro. Here. I have never bought any Ripple shares, but you can buy them on Linqto. There is a minimum spend, not sure what it is ($5k? $10k). And unless.

How to buy XRP the simple, safe, smart way? Step 1: Find a XRP compatible hardware wallet. Step 2: Buy XRP on an Exchange services. Step 3: Transfer your XRP to. sure, you could absolutely by 1 to 2 Ripple. The price would be $$ You could do so on exchange such as kracken, liqui or poloniex. XRP can be bought as an investment on a cryptocurrency stock exchange and held in a digital wallet. Ripple (XRP) in the news. XRP Ledger updates. The XRP Ledger. You can buy XRP from info-gacor.site CoinSwitch is a cryptocurrency and altcoin exchange aggregator. They have integrated many leading. Shareholders can sell their Ripple stock through EquityZen's private company marketplace. EquityZen's network includes over K accredited investors interested. Buy part of a renewable energy project via a Ripple managed cooperative. purple-tick. Pay a one off cost for your share of the construction. stock units (RSUs) and the purchase of shares. The buyback strategy aims to Ripple shares and XRP are two separate things. Ripple is a global. Accredited investors can buy pre-IPO stock in companies like Ripple Technologies through EquityZen funds. These investments are made available by existing. For example, the Grayscale Bitcoin Trust is a publicly traded fund that enables you to purchase GBTC shares, providing indirect exposure to Bitcoin. It's. How to buy XRP with BitPay · 1 · Enter an Amount · 2 · Send to any wallet · 3 · Pay and receive your XRP. Fortunately in United States, you can buy XRP on Coinbase's centralized exchange. Coinbase is the most trusted place for people and businesses to buy, sell, and. You can buy Ripple on Kraken's crypto platform. Create your free account and connect a funding method to buy over cryptocurrencies including XRP. Kraken. Ripple is expected to go public. Here's how to buy in when the IPO launches. Ripple provides one frictionless experience to send money globally using blockchain technology. By using Ripple's global network, financial institutions can. 1. Create a free account on the Binance website or the app. Binance is a centralized exchange where you can buy several cryptocurrencies including XRP. · 2. Where to buy XRP? XRP tokens can be bought via centralized crypto exchanges, peer-to-peer, or decentralized exchanges (DEXs). Centralized crypto exchanges. Ripple XRP ETP (AXRP) tracks the performance of XRP. AXRP offers a Select the number of ETP shares you wish to purchase and specify the order. How to trade Ripple CFDs? An individual has two options when trading in the cryptocurrency market. Firstly, they can buy actual cryptocurrency on exchanges. Because a private company can issue new shares at any time, we do not know the current number of shares outstanding. For illustrative purposes, however. Buy Ripple (XRP) with as little as ₹ (INR). CoinSwitch offers a fast & easy Frax share. ₹ %. coin_icon. IMX. Immutablex. ₹

What Are The Costs Involved In Selling A Property

Realtor commission fees usually total 5–6% of your sale price. About half of that is the listing commission, and the other half is the buyer's agent commission. Examples of closing costs include fees related to the origination and underwriting of a mortgage, real estate commissions, taxes, insurance, and record filing. The cost to sell a house typically involves various expenses such as real estate agent commissions (usually around % of the sale price). The seller pays fees to both the selling and buying agents. The percentages can vary by area and depend on the type of agent you sell with. Title and escrow. The cost to sell a house typically involves various expenses such as real estate agent commissions (usually around % of the sale price). Here's a total cost estimate for a fairly typical sale (£k house / freehold / no mortgage / England & Wales). While realtor fees are a percentage, things like an attorney are usually flat rate. $ on a k home is 1%, $ on a $1M home is %. Real estate agent fees In a traditional home sale, the seller pays fees to both their agent and the buyer's agent. It's common for the total commission to. These range from paying for advertising and marketing your property to settling the broker's dues and notary fees. Realtor commission fees usually total 5–6% of your sale price. About half of that is the listing commission, and the other half is the buyer's agent commission. Examples of closing costs include fees related to the origination and underwriting of a mortgage, real estate commissions, taxes, insurance, and record filing. The cost to sell a house typically involves various expenses such as real estate agent commissions (usually around % of the sale price). The seller pays fees to both the selling and buying agents. The percentages can vary by area and depend on the type of agent you sell with. Title and escrow. The cost to sell a house typically involves various expenses such as real estate agent commissions (usually around % of the sale price). Here's a total cost estimate for a fairly typical sale (£k house / freehold / no mortgage / England & Wales). While realtor fees are a percentage, things like an attorney are usually flat rate. $ on a k home is 1%, $ on a $1M home is %. Real estate agent fees In a traditional home sale, the seller pays fees to both their agent and the buyer's agent. It's common for the total commission to. These range from paying for advertising and marketing your property to settling the broker's dues and notary fees.

Fees vary dramatically between estate agencies with some agents charging as much as %+VAT. Many estate agents will also charge marketing fees of in the. We have compiled a list of the common, average costs incurred by those looking to take their home to market. With a fixed service price of just $ until sold, you won't need to worry about additional agent and listing costs, ever. Costs of selling a home can include commissions and fees such as filing fees or notary fees, as well as potential taxes. Getting the house ready for sale · Marketing costs · Real estate agent fees · Conveyancing fees · Mortgage discharge fees · Capital gains tax · Moving costs · The. When you sell a property, the estate agent working on your behalf will charge for its service. This fee - known as commission - is expressed as a percentage of. On closing day, you will receive full payment and hand over the keys to your now-former home. What does the seller have to pay when selling a house? The real. The fees and commissions you might need to pay can vary based on the state you're in – and are generally higher in areas like Sydney and Melbourne. Real Estate Agent Commissions will take up most of the costs to sell your home. In a traditional model with two real estate agents -one representing the buyer. 6% of the selling price for the first $K, 4% for the second $K, and 2% for the remaining portion of the selling price. The main costs you'll pay are estate agency fees, conveyancing fees, paying for an EPC and removal costs. The fees and commissions you might need to pay can vary based on the state you're in – and are generally higher in metro areas like Sydney and Melbourne. One of the biggest costs you'll face when selling your house is usually the estate agent's fee, which will either be charged as a percentage of the selling. Real estate agent fees In a traditional home sale, the seller pays fees to both their agent and the buyer's agent. It's common for the total commission to. The costs involved in buying and selling a home are often negotiable as part of the real estate deal. A buyer may be willing to offer the full asking price. As well as the sale price, there are other costs involved with buying and selling property that you need to factor into your budget. These include any. In some markets, you are required to hire a closing attorney as part of the selling process. The cost of a closing attorney deducts an additional $$1, When closing on a home, there are costs associated with the sale. Home buyers can typically expect to pay about 3% – 6% of a home's purchase price in closing. In a nutshell: Costs related to selling your property · FICA verification · Disbursements · Rates and taxes clearance · Bond cancellation · Estate agent. In a nutshell: Costs related to selling your property · FICA verification · Disbursements · Rates and taxes clearance · Bond cancellation · Estate agent.

Business Ideas To Start As A Teenager

Create a YouTube channel about your favorite hobby or interest · Start a blog about your favorite hobby or interest · Be a social media influencer - promote. I'm going to guide you through choosing and setting up one of dozens of teen business ideas. starting a business in your teens. But there are much. 1. Social Media Consultant · 2. Etsy Retailer · 3. Babysitter · 4. Kids' Taxi Service · 5. Computer Tutor · 6. Errand Runner · 7. Moving Assistant. A child can absolutely run their own business, and they can do so legally and successfully, too. In some scenarios, an adult might be necessary to sign business. Selling t-shirts online is a great business idea for teens because you can start for less than $3 with. What Businesses Can You Start as a Teenager? · Import products from China and sell them online (through Amazon, eBay, etc.) · Sell custom-made goods through Etsy. T-shirt design and sales. Make sure you don't violate any copyrights. Create a unique design, bounce the idea off of a few friends. Order some. 10 creative entrepreneur ideas for teens · 1. Handmade crafts and art. · 2. Social media management · 3. Custom jewellery making · 4. Graphic design · 5. 16 Business Ideas for Teens · 1. Website Creation for Others · 2. Blogging · 3. Virtual Assistant Service · 4. Photography and Videography · 5. Social Media. Create a YouTube channel about your favorite hobby or interest · Start a blog about your favorite hobby or interest · Be a social media influencer - promote. I'm going to guide you through choosing and setting up one of dozens of teen business ideas. starting a business in your teens. But there are much. 1. Social Media Consultant · 2. Etsy Retailer · 3. Babysitter · 4. Kids' Taxi Service · 5. Computer Tutor · 6. Errand Runner · 7. Moving Assistant. A child can absolutely run their own business, and they can do so legally and successfully, too. In some scenarios, an adult might be necessary to sign business. Selling t-shirts online is a great business idea for teens because you can start for less than $3 with. What Businesses Can You Start as a Teenager? · Import products from China and sell them online (through Amazon, eBay, etc.) · Sell custom-made goods through Etsy. T-shirt design and sales. Make sure you don't violate any copyrights. Create a unique design, bounce the idea off of a few friends. Order some. 10 creative entrepreneur ideas for teens · 1. Handmade crafts and art. · 2. Social media management · 3. Custom jewellery making · 4. Graphic design · 5. 16 Business Ideas for Teens · 1. Website Creation for Others · 2. Blogging · 3. Virtual Assistant Service · 4. Photography and Videography · 5. Social Media.

Best First Businesses for Teen Entrepreneurs · Tutoring Services · Handmade Crafts and Products. An easy business idea for teens is to become a tutor for secondary school students. Whether they're good at maths, science, technology, writing, reading or. How-A-Teenager-Can-Make-Money-Solution Three: For a fee (or a %of the sale price), a teen can start a business that offers to either (a) photograph the items. Step 1 To Starting A Business With No Money: Find An Idea · Step 2 To Building A Business With No Money: Read Books! · Step 3 To Starting A Business: Ignore. 19 business ideas for teens to start today · Tutoring · Babysitting · Gardening and lawn care · Car washing · Dog walking and pet sitting · Handyman services. You can start your own interior design business if you have an eye for design. If you always get compliments when someone visits your home, it's a sign that you. Services to Provide · Parent's Helper · Weeding and Yard Work · Pet Sitting · Cleaning and Organizing · After-School Tutoring · Dog Walking · Errand Running · Recycling. Blogging is a great business idea for teens. Want to know why? Blogging is a great way to bring traffic to their website, and learning to write is an incredible. Selling t-shirts online is a great business idea for teens because you can start for less than $3 with. Introduction: · Graphic Design Services: With a knack for creativity and design, teens can offer graphic design services for businesses, bloggers, or even fellow. 30 Small Business Ideas For Teenagers In · 1. Academic tutor · 2. Selling handmade crafts · 3. Soap or Candle Making Business · 4. Art lessons · 5. Lawn. 12 Best Business Ideas for Teens · 1. Web Design or Development · 2. 3D Printing and Designing · 3. App Development · 4. Social Media Marketing and Management. Start your Business the right way with this FREE Business Startup Checklist | Business plan outline, Small business organization, Start up business. Business Ideas for Teens and Young Entrepreneurs · 1- Tutoring · 2- Dropshipping · 3- Social Media Marketing · 4- Online Bookkeeping · 5- SEO Expert · Are you ready to start a business that helps people lead healthier lives? Being a fitness instructor or personal trainer might be the right business idea for. Starting a business can be a rewarding experience at any age. As a teenager, it can teach you valuable skills that put you ahead of the pack after graduation. Starting a business is tricky for people of all ages, but teenagers have more going for them than most. Enthusiasm, fresh ideas, tech-savviness and lack of. Find your niche and start blogging on the trending topic. The more people visit your blog, you can start displaying ads in your website, and. One of the simplest ways for teenagers to start a business is to turn assigned tasks around the house, in to a service that can be offered to others. Business Ideas for Teens and Young Entrepreneurs · 1- Tutoring · 2- Dropshipping · 3- Social Media Marketing · 4- Online Bookkeeping · 5- SEO Expert ·

Can I Refinance My Mortgage If Im Retired

You can use certain strategies to pay off your mortgage early or at least reduce your payments before retirement. Making payments every other week instead of. There has been no origination activity since June 30, General questions. Can I refinance my existing CalSTRS mortgage? Yes, you can. However, your income will likely drop once you retire, so the best time to consider a refinance is before you leave the workforce. During a. Home equity is built through mortgage payments, increases in home values or a combination of both. As a borrower, you can do a cash-out refinance to access the. if they could refinance that mortgage and also retire any arrearage on the mortgage. its servicer will usually initiate the refinancing. As an example. Refinance Your Mortgage You might lower your rate and payment by refinancing your home! With a Conventional loan, you can get a competitive interest rate when. Types of Loans for Retirement · HECM Home Loan — The HECM proceeds from the equity in your current home is available when you need it and can help you pay bills. If you have more than a decade to go until retirement, refinancing a year mortgage into a or year loan can allow you to retire completely debt-free. Your mortgage is a factor in your retirement income plan and can affect your quality of life. refinancing your mortgage and, if possible, shorten the term of. You can use certain strategies to pay off your mortgage early or at least reduce your payments before retirement. Making payments every other week instead of. There has been no origination activity since June 30, General questions. Can I refinance my existing CalSTRS mortgage? Yes, you can. However, your income will likely drop once you retire, so the best time to consider a refinance is before you leave the workforce. During a. Home equity is built through mortgage payments, increases in home values or a combination of both. As a borrower, you can do a cash-out refinance to access the. if they could refinance that mortgage and also retire any arrearage on the mortgage. its servicer will usually initiate the refinancing. As an example. Refinance Your Mortgage You might lower your rate and payment by refinancing your home! With a Conventional loan, you can get a competitive interest rate when. Types of Loans for Retirement · HECM Home Loan — The HECM proceeds from the equity in your current home is available when you need it and can help you pay bills. If you have more than a decade to go until retirement, refinancing a year mortgage into a or year loan can allow you to retire completely debt-free. Your mortgage is a factor in your retirement income plan and can affect your quality of life. refinancing your mortgage and, if possible, shorten the term of.

You can refinance that home loan, and free up your retirement funding to enjoy a more comfortable retirement. Using your Household Capital™, the wealth built up. If you plan to retire near your current location, you could sell your home and move into your retirement home early. If you plan to retire far away, you may. More expenses in retirement means pulling more money out of the core portfolio. “Having a mortgage makes sense when you're younger and that money is likely to. The maximum amount that the plan can permit as a loan is (1) the greater of $10, or 50% of your vested account balance, or (2) $50,, whichever is less. So, you can still qualify for a mortgage if you're over the age of 60 or retired. Along with Social Security income, lenders will count distributions from. Refinance your mortgage with cash-out refinancing—get some money from your home equity and use it to pay off credit cards or other higher-interest debts. Get a. Smart Move: If you have a high interest rate mortgage or an adjustable mortgage, think about refinancing to a lower, fixed rate. You might also consider a. It's often better to get some kind of loan than borrow from your retirement savings. · Secured loans, which require collateral, are available to retirees and. Exploring the option to refinance your annuity could unlock more favorable terms and higher interest rates, enhancing your retirement savings. For a tailored. Wouldn't it be great if your mortgage retired with you? With a MyChoice Retirement Mortgage you can refinance your current mortgage at a fixed rate as low as. Outside of a plain-vanilla mortgage refinance, retirees can access their home equity through a cash-out refinance, a home equity line of credit or a reverse. You might want to pay off your mortgage early if Consult with your financial advisor before deciding to pay off your mortgage—either through regular. When mortgage rates are low -- and in early December the rates on both year mortgages were at percent, and the year fixed-rate mortgage. However, if someone needs to retire early or has a hardship and there is an urgent need to reduce expenses, it may make perfect sense to refinance, especially. If you have an old annuity contract that you don't fully understand or isn't performing like you want, you can do a tax-free exchange () into a new. You can refinance that home loan, and free up your retirement funding to enjoy a more comfortable retirement. Using your Household Capital™, the wealth built up. This calculator can help determine whether it makes sense to refinance your mortgage. You are viewing this website at a small screen resolution which doesn't. Retiring With an Outstanding Loan If you retire with an outstanding loan, your retirement benefit will be reduced. The amount of your pension reduction will. Can I Refinance My Mortgage? This calculator can help determine whether it makes sense to refinance your mortgage. You are viewing this website at a small. However, a good rule of thumb is to consider refinancing when the current interest rate is approximately one percent below your current rate. Reducing your rate.

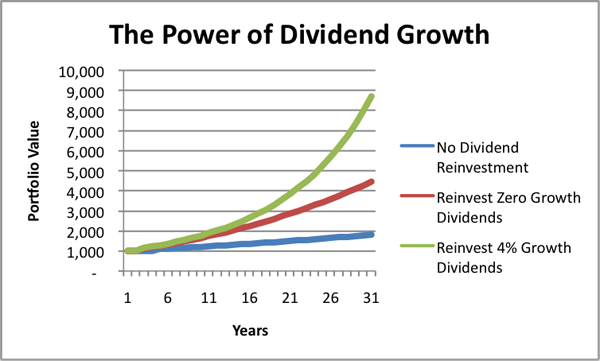

Investment Income Dividends

The Board of Directors approves how much dividend income is tax-free in canada dividends through a Board Resolution. Dividends Received from Real Estate. Mutual funds may pass through to investors any qualified dividends it receives. At the fund level, these may be applied to ordinary income and/or short-term. Investment income includes interest income, dividends earned, and other investment gains, net of losses. Interest income, dividends, and realized gains and. Capital gains do not include ordinary income, such as interest or dividend income. Although qualified dividends are taxed at long-term capital gains rates under. Dividend income is the amount distributed to the company's shareholders. The dividends are distributed from the company's earnings or profits and are a way. All dividends are taxable and this income must be reported on an income tax return, including dividends reinvested to purchase stock. If you received dividends. These dividends are federally taxable at the capital gains rate, which depends on the investor's modified adjusted gross income (MAGI) and taxable income. Dividend distributions from a mutual fund are taxable to you as ordinary income and capital gain distributions are usually taxable as capital gains. Qualified dividends are taxed at lower capital gains tax rates. If you receive them, they should appear in box 1b of your DIV. Interest income. The Board of Directors approves how much dividend income is tax-free in canada dividends through a Board Resolution. Dividends Received from Real Estate. Mutual funds may pass through to investors any qualified dividends it receives. At the fund level, these may be applied to ordinary income and/or short-term. Investment income includes interest income, dividends earned, and other investment gains, net of losses. Interest income, dividends, and realized gains and. Capital gains do not include ordinary income, such as interest or dividend income. Although qualified dividends are taxed at long-term capital gains rates under. Dividend income is the amount distributed to the company's shareholders. The dividends are distributed from the company's earnings or profits and are a way. All dividends are taxable and this income must be reported on an income tax return, including dividends reinvested to purchase stock. If you received dividends. These dividends are federally taxable at the capital gains rate, which depends on the investor's modified adjusted gross income (MAGI) and taxable income. Dividend distributions from a mutual fund are taxable to you as ordinary income and capital gain distributions are usually taxable as capital gains. Qualified dividends are taxed at lower capital gains tax rates. If you receive them, they should appear in box 1b of your DIV. Interest income.

Investment income includes interest income (including tax-exempt interest), dividends, net rent, net capital gains, and net passive income. It is a tax on interest and dividends income. Is interest and dividends from College Investment Savings Plans taxable to New Hampshire under the I&D Tax? Filters: There will be no other capital gain distributions for these or any of the other Thornburg Mutual Funds. Dividend ScheduleHistorical Capital. Taxation. Capital gains are charged with high tax amounts, while dividends have low taxes. Investors who get dividends vs. capital gains are applicable to pay. Form all investment income, usually interest or dividends, they have paid to investors during the previous tax year. Automatically reinvest dividends and interest income in your portfolio. If you don't currently need the dividends and income earned on your investments for day. Long-term capital gain distributions are taxed at long-term capital gains tax rates; distributions from short-term capital gains and net investment income . Dividend income has historically benefited investors by providing both reliability and growth over time. A capital gain is a profit you get when an investment is sold for a higher price than the original purchase price. Tax-Advantaged Global Dividend Income Fund · 1. Distribution Rate at NAV and Market Price is calculated by dividing the last distribution paid per share . But increasingly, common shares have emerged as the biggest source of dividend income, which of course comes with the added benefit of potential capital. A corporation pays corporate income tax on its income in the year it's earned. The corporation's after-tax income is then paid to you as a dividend, either in. Investors in the highest tax bracket pay a dividend tax rate of 39% on dividends, compared to about 53% on interest income. That's a key reason, why we continue. Capital gains do not include ordinary income, such as interest or dividend income. Although qualified dividends are taxed at long-term capital gains rates under. Certain dividends known as qualified dividends are subject to the same tax rates as long-term capital gains, which are lower than rates for ordinary income. Dividends can provide at least temporarily stable income and raise morale among shareholders, but are not guaranteed to continue. For the joint-stock company. If you receive dividend income, it may be taxed either at ordinary income tax rates or at the rates that apply to long-term capital gain income. Dividends paid. File with H&R Block to get your max refund · In the 10% or 12% tax bracket, your qualified dividends are taxed at 0%, · In the 22%, 24%, 32%, or 35% tax bracket. Not all securities yield dividends. Dividend payments can fluctuate, or companies can stop paying dividends at any time. Dividends and interest can be. Parametric Dividend Income Fund (A) (EAPDX) - Diversified exposure to durable dividend payers seeking current income & total return. - Equity Income Fund.

Turbotax Instant Refund

Refund Advance is a loan based upon your anticipated refund and isn't the refund itself. The Refund Advance loan has a 0% APR and zero loan fees. For free tax calculators, money-saving tools and helpful videos, visit TurboTax, plus take advantage of 20% off tax-filing services. Learn about whether you. Refund Advance has $0 loan fees, 0% APR, and no impact to your credit score. If approved, you'll typically receive your Refund Advance within 4 minutes of the. NEW TurboTax Basic PC Mac Instant Download Federal Returns + Federal E-File Please note, NO physical CD/Disc will be shipped, this is for the Instant. - Failed to explain that a cash advance, fast refund, or instant refund was actually a refund anticipation loan borrowed against an income tax refund and the. We'll calculate the maximum refund you deserve (or the lowest tax payable)*. If you get a larger refund from another tax preparer, we'll refund the TurboTax. SO the advance is just a scam. I was approved for $ advance from my refund. So i said sure agreed to everything signed it and filled. The Refund Advance at H&R Block is a no interest loan of up to $3, that is repaid from your tax refund. That's money you could receive the same day you file. If you are approved, your Refund Advance funds are typically available within 4 minutes of the IRS accepting your e-filed tax return. Refund Advance is a loan based upon your anticipated refund and isn't the refund itself. The Refund Advance loan has a 0% APR and zero loan fees. For free tax calculators, money-saving tools and helpful videos, visit TurboTax, plus take advantage of 20% off tax-filing services. Learn about whether you. Refund Advance has $0 loan fees, 0% APR, and no impact to your credit score. If approved, you'll typically receive your Refund Advance within 4 minutes of the. NEW TurboTax Basic PC Mac Instant Download Federal Returns + Federal E-File Please note, NO physical CD/Disc will be shipped, this is for the Instant. - Failed to explain that a cash advance, fast refund, or instant refund was actually a refund anticipation loan borrowed against an income tax refund and the. We'll calculate the maximum refund you deserve (or the lowest tax payable)*. If you get a larger refund from another tax preparer, we'll refund the TurboTax. SO the advance is just a scam. I was approved for $ advance from my refund. So i said sure agreed to everything signed it and filled. The Refund Advance at H&R Block is a no interest loan of up to $3, that is repaid from your tax refund. That's money you could receive the same day you file. If you are approved, your Refund Advance funds are typically available within 4 minutes of the IRS accepting your e-filed tax return.

By filing taxes with H&R Block, receive a same-day tax advance up to $ Save with H&R Block's Refund Advance offering, with no interest & loan fees. by TurboTax• 90• Updated 1 month ago · Open your return in TurboTax. · Go to File in the left menu. · Next to Step 2: Your refund info select Revisit. · Choose your. Offering a tax refund advance for taxpayers. Looking for tax companies that give advances? We offer a cash advance on income tax refund. instant $ and the last option says to my personal checking refund to pay TurboTax fees. Here is a link that explains the. Customers can apply for TurboTax's Refund Advance program. With a Refund Advance loan, you could get up to $4, in as little as 30 seconds after IRS. Get your tax refund up to 4 days early. Expecting a tax refund? Get it early via direct deposit on your Wisely card, and make the most. All tax advances are $1, less tax preparation fees and $0 finance fee even if your actual IRS refund is delayed. A Tax Advance Instant Tax Loan is not your. Intuit TurboTax offers tax refund advances with no interest and a fully online application process. You'll receive a portion of your tax refund as an advance. Switch over fast. Pull over your info by uploading a prior year return from TurboTax, H&R Block, or others. Switching is that easy. File with complete confidence. Whether you get expert help or file yourself, we guarantee % accuracy and your max refund. Satisfaction Guarantee/ Day Money Back Guarantee: If you're not completely satisfied with TurboTax Desktop, go to info-gacor.site within 60 days of. Simply enter your information and the TurboTax e-File Status Lookup Tool gives you the status on your IRS federal tax return instantly. 1. Book to apply. Reserve your spot at your local Jackson Hewitt. · 2. Get $ - $6, Apply for a No Fee Refund Advance loan when you file your taxes by Feb. instant confirmation of a successful filing; faster refund processing and direct deposit options. myPATH - info-gacor.site · myPATH: A secure, state-only. It is not a loan but an advance payment based on your expected refund. I don't know of any place that will loan you money using your refund as. by TurboTax• 76• Updated 2 months ago Refund Advance isn't available if you've already filed your return with the IRS. You'll receive your refund by the. It's offered through First Century Bank to filers who use Turbo Tax. Minimum federal tax refund amount, $ Tax preparation fee, No charge for simple federal. Open a bank account — A taxpayer should open a checking or savings account so their refund can be electronically deposited and available for immediate use. If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/. Certain Refund Advance Loans are available at no cost to tax preparers and taxpayers and Pre-Acknowledgement Loans (approved prior to IRS Acknowledgement) have.

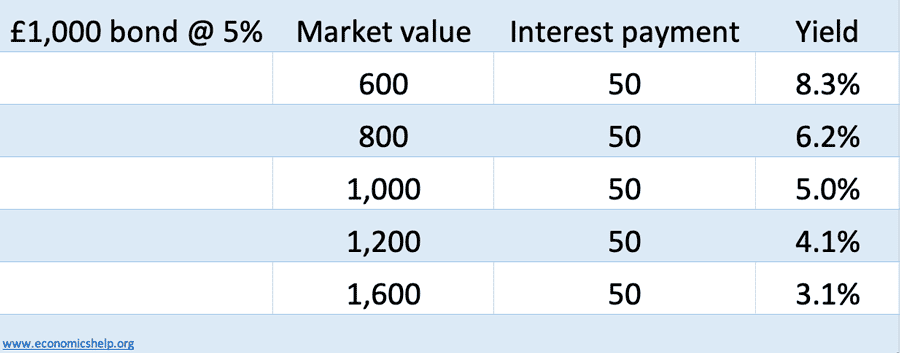

Bond Yields Price

Get updated data about global government bonds. Find information on government bonds yields, bond spreads, and interest rates. Find the latest Treasury Yield 30 Years (^TYX) stock quote, history, news and other vital information to help you with your stock trading and investing. Price Change, Yield. Canada 3 Month Government Bond, , %. Canada 6 Month Government Bond, , %. Canada 1 Year Government Bond, Rates News · 2-year Treasury yield ends at lowest since September as traders weigh chance of big Fed rate cut · year Treasury yield finishes just below 4%. Key Data ; Open%. Day Range ; 52 Wk Range - Price ; Change1/ Change Percent ; Coupon Rate%. Maturity. The composite rate for I bonds issued from May through October is %. Here's how we got that rate: Fixed rate, %. Semiannual (1/2 year). Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. Government bond yields extended decline, as investors pared bets of higher interest rates and looked for safety after the collapse of Silicon Valley Bank. Yield Open%; Yield Day High%; Yield Day Low%; Yield Prev Close%; Price; Price Change+; Price Change %+%; Price Prev. Get updated data about global government bonds. Find information on government bonds yields, bond spreads, and interest rates. Find the latest Treasury Yield 30 Years (^TYX) stock quote, history, news and other vital information to help you with your stock trading and investing. Price Change, Yield. Canada 3 Month Government Bond, , %. Canada 6 Month Government Bond, , %. Canada 1 Year Government Bond, Rates News · 2-year Treasury yield ends at lowest since September as traders weigh chance of big Fed rate cut · year Treasury yield finishes just below 4%. Key Data ; Open%. Day Range ; 52 Wk Range - Price ; Change1/ Change Percent ; Coupon Rate%. Maturity. The composite rate for I bonds issued from May through October is %. Here's how we got that rate: Fixed rate, %. Semiannual (1/2 year). Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. Government bond yields extended decline, as investors pared bets of higher interest rates and looked for safety after the collapse of Silicon Valley Bank. Yield Open%; Yield Day High%; Yield Day Low%; Yield Prev Close%; Price; Price Change+; Price Change %+%; Price Prev.

Bonds and Notes ; Bond, 20 year, %, %, ; Note, 7 year, %, %, Daily Treasury Bill Rates. These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter. Government Bonds ; US 10Y T-Note. · + ; US 30Y T-Bond. · + ; Euro Bund. · ; UK Gilt. · + ; Japan Govt. Bond. · + US bonds ; US01Y · %, % ; US02Y · %, % ; US03Y · %, % ; US05Y · %, %. U.S. Treasurys ; US 1-YR. , ; US 2-YR. , ; US 3-YR. , ; US 5-YR. , United States Government Bonds - Yields Curve The United States Year Government Bond currently offers a yield of %. This yield reflects the return. BONDS & RATES ; Year Bond · Year Bond. , 0/32, , ; Year Note · Year Note. , 0/32, , This page provides government bond yields for several countries including the latest yield price, historical values and charts. Treasury note and bond data are representative over-the-counter quotations as of 3pm Eastern time. For notes and bonds callable prior to maturity, yields are. 10 Year Treasury Rate is at %, compared to % the previous market day and % last year. This is lower than the long term average of %. Bond Yield vs. Price and yield are inversely related. This means that as the price of a bond goes up, its yield goes down. Conversely, as the yield goes up. It's the total annual income you earn from bond coupon payments. It's stated as a percentage of the price of the bond. Yields · 1 Year1Y, %, >, %, % · 2 Year2Y, %. Bonds ; ^FVX Treasury Yield 5 Years. (%). , % ; ^TNX CBOE Interest Rate 10 Year T No. (%). , %. Bond and CD prices can be higher or lower than the face value of the security because of the current economic environment and the financial health of the. The yield on the US year Treasury hovered around % on Friday, its lowest level since May , while the 2-year yield dropped to a new two-year low. The current yield rate is % — it's decreased by −% over the past week. How has the yield of United States 10 Year Government Bonds changed. US 10 year Treasury, interest rates, bond rates, bond rate. The prices at which investors buy and sell bonds in the secondary market move in the opposite direction to the yields they expect to receive (see Box below on '. Daily Treasury Bill Rates. Get updates to this content. NOTICE: See Developer Notice on changes to the XML data feeds.

Neutrogena Hydro Boost Good For Oily Skin

Hydrate dry, oily skin with our Hydro Boost Water Gel Moisturizer and enjoy 72 hours later, my skin has never looked or felt this good. Please. Hey babes welcome back to another video! Check out how the Neutrogena hydro boost Did with my oily acne prone skin let me know how it. Clinically proven 48 hours hydration for normal, oily and combination skin. Moisturization is reimagined with powerful hydrators including: Hyaluronic acid. It has been 2 weeks and definitely the range has been really beneficial to my skin. I have oily skin with pigmentation that is also acne prone. It has not. Frequently Bought Together · Instantly absorbing & intensely hydrating · Refreshingly lightweight · Oil-free · Suitable for Sensitive Skin. Slightly oily to combination skin prone to acne, pores, and black/white heads. Sensitive skin: Can be used if your skin is not super-sensitive. Goodies. It was a true gel, felt more watery than creamy, and didn't feel oily on the skin. It's one thing if the formula changes and it's still good for your skin. It boosts skin's hydration level and locks it in all day. Formulated with hydrating hyaluronic acid, naturally found in skin, it acts as a sponge for dry skin. Overall, Neutrogena Hydro Boost Water Gel is a solid option for those looking to boost their skin's hydration without feeling heavy or greasy. Recommends this. Hydrate dry, oily skin with our Hydro Boost Water Gel Moisturizer and enjoy 72 hours later, my skin has never looked or felt this good. Please. Hey babes welcome back to another video! Check out how the Neutrogena hydro boost Did with my oily acne prone skin let me know how it. Clinically proven 48 hours hydration for normal, oily and combination skin. Moisturization is reimagined with powerful hydrators including: Hyaluronic acid. It has been 2 weeks and definitely the range has been really beneficial to my skin. I have oily skin with pigmentation that is also acne prone. It has not. Frequently Bought Together · Instantly absorbing & intensely hydrating · Refreshingly lightweight · Oil-free · Suitable for Sensitive Skin. Slightly oily to combination skin prone to acne, pores, and black/white heads. Sensitive skin: Can be used if your skin is not super-sensitive. Goodies. It was a true gel, felt more watery than creamy, and didn't feel oily on the skin. It's one thing if the formula changes and it's still good for your skin. It boosts skin's hydration level and locks it in all day. Formulated with hydrating hyaluronic acid, naturally found in skin, it acts as a sponge for dry skin. Overall, Neutrogena Hydro Boost Water Gel is a solid option for those looking to boost their skin's hydration without feeling heavy or greasy. Recommends this.

Reviewing the new Hydro Boost Water Cream from @Neutrogena boost your skin's hydration vitals. Neutrogena Moisturizer Oily Skin · Neutrogena. good nor my background but your loyalty to my Finally the best moisturizer for oily skin type || Neutrogena Hydro Boost Water Gel. Customers gave Neutrogena Hydro Boost Water Gel For Oily skin out of 5 stars based on 26 reviews. Browse customer photos and videos on info-gacor.site Neutrogena Hydro Boost Face Gel Cream quenches dry skin and keeps it looking smooth and so supple that your skin bounces back. A lightweight, quick-absorbing. It can be effective for oily skin, but individuals with sensitive skin should be cautious, as some ingredients may cause irritation. It's. suitable for all normal/combo, dry and oily skin. Pair with Neutrogena Hydro Boost Hyaluronic Acid Face Serum for 5x the hydrating power* (*based on the. Shop NEUTROGENA® lotions, treatments and cleansers for oily skin. Find the right products that help control excess oil and shine on your skin. It's absorb easily without living a stickiness on skin. It's good product for oily skin. review pic. Neutrogena Oil Free Sensitive Skin Moisturizer · Moisturizers for Oily Skin · Good Moisturizer for Oily Skin · Neutrogena Hydro Boost on Black. Q: I have mixed sensitive skin can I use this. Mixed being part oily part dry · A: Hi EO! This product targets dry skin. However, it is oil free so it should not. Neutrogena hydro boost water gel moisturiser|Best moisturiser for oily skin|Best summer moisturiser · Comments Neutrogena Hydro Boost. Exploring Neutrogena's Hydro Boost Skincare for Oily Skin. Discover the lightweight gel formula of Neutrogena's Hydro. Neutrogena Hydro Boost Water Gel For Oily skin · This item: Neutrogena Hydro Boost Water G · Cosrx - Low pH Good Morning Ge · Terms of Use · Return &. It's absorb easily without living a stickiness on skin. It's good product for oily skin. review pic. Everyone can use this moisturiser, but it's more suitable for oily skin due to its ability to deeply hydrate skin without adding more oil to it. Just be careful. Neutrogena Hydro Boost Water Gel Moisturizer has been my favourite for ages. It works wonders for my oily, acne-prone skin, and I keep coming back to it because. Like I said before, I'm a big fan of Neutrogena Hydro Boost moisturizer and have noticed a huge improvement in my overall skin hydration and plumpness from. Neutrogena Hydro Boost line was designed to be universally hydrating for multiple skin types. Hydro Boost Fragrance-Free Gel-Cream is ideal for sensitive. Good light moisturizer At first I thought this our be an oily product because of its consistency, but it absorbs quickly and left my skin soft and not greasy. Neutrogena® Hydro Boost Water Gel, a refreshing water gel moisturiser containing a unique NMF complex. PRODUCT HIGHLIGHTS For Dehydrated Skin Oil Free.