info-gacor.site

Prices

Svfd Stock

Save Foods Inc. (SVFD) Stock Charts Save Foods Inc. (SVFD): $ ( POWR Rating Get Rating Component Grades Growth Get Rating Value. Carbon Collective's Climate Index lists + green stocks that build climate solutions found in Project Drawdown's comprehensive plan to solve climate. Institutional Ownership and Shareholders. Save Foods, Inc. (US:SVFD) has 14 institutional owners and shareholders that have filed 13D/G or 13F forms with the. The Symbol SVFD was not found. Here are some similar symbols and popular Free Stock Reports · Insider Trades · Trade Idea Feed · Analyst Ratings · Unusual. SVFD · PRICE ACTION · $ · FINANCIALS · WHAT DOES THE MARKET THINK? POOR · NEWEST ALERTS · MOMENTUM · WHERE IS SVFD? · SVFD SOCIAL TRENDS. Get the latest Save Foods Inc. (SVFD) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. Save Foods' stock was trading at $ at the beginning of the year. Since then, SVFD stock has decreased by % and is now trading at $ View the best. N2OFF Stock Forecast, SVFD stock price prediction. Price target in 14 days: USD. The best long-term & short-term N2OFF share price prognosis for Check the Save Foods, Inc. stock price today on the NASDAQ stock exchange and access historical SVFD stock price chart. Get the latest Save Foods. Save Foods Inc. (SVFD) Stock Charts Save Foods Inc. (SVFD): $ ( POWR Rating Get Rating Component Grades Growth Get Rating Value. Carbon Collective's Climate Index lists + green stocks that build climate solutions found in Project Drawdown's comprehensive plan to solve climate. Institutional Ownership and Shareholders. Save Foods, Inc. (US:SVFD) has 14 institutional owners and shareholders that have filed 13D/G or 13F forms with the. The Symbol SVFD was not found. Here are some similar symbols and popular Free Stock Reports · Insider Trades · Trade Idea Feed · Analyst Ratings · Unusual. SVFD · PRICE ACTION · $ · FINANCIALS · WHAT DOES THE MARKET THINK? POOR · NEWEST ALERTS · MOMENTUM · WHERE IS SVFD? · SVFD SOCIAL TRENDS. Get the latest Save Foods Inc. (SVFD) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. Save Foods' stock was trading at $ at the beginning of the year. Since then, SVFD stock has decreased by % and is now trading at $ View the best. N2OFF Stock Forecast, SVFD stock price prediction. Price target in 14 days: USD. The best long-term & short-term N2OFF share price prognosis for Check the Save Foods, Inc. stock price today on the NASDAQ stock exchange and access historical SVFD stock price chart. Get the latest Save Foods.

Get a comprehensive overview of Save Foods, Inc. (SVFD). Explore key data, stock performance, and market trends for informed investment decisions. N2OFF, Inc. - SVFD STOCK NEWS. Welcome to our dedicated page for N2OFF news (Ticker: SVFD), a resource for investors and traders seeking the latest. If you don't study any companies, you have the same success buying stocks as you do in a poker game if you bet without looking at your cards. Utilize notes to. undefined share price live: SVFD Live stock price with charts, valuation, financials, price target & latest insights. You can watch SVFD and buy and sell other stock and options commission-free on Robinhood. Change the date range, see whether others are buying or selling. Save Foods, Inc. - stock earnings. Dividends · Price · Splits · Earnings · Financials. SVFD Quarterly earnings. Q2. SVFD stock price today + long-term Save Foods - SVFD stock price, relative strength, and seasonality charts to give you perspective on today's SVFD stock. Save Foods stock news, updates & related news. Find out why Save Foods's (SVFD) news sentiment is % more positive in relation to stocks in the Basic. undefined share price live: SVFD Live stock price with charts, valuation, financials, price target & latest insights. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for - (SVFD) stock. Gain valuable insights from earnings call transcripts. The latest Save Foods stock prices, stock quotes, news, and SVFD history to help you invest and trade smarter. Save Foods Inc. (SVFD) Stock Charts · Save Foods Inc. (SVFD): $ · Get Rating · Component Grades · Save Foods Inc. (SVFD) Performance Graph for POWR Ratings. Learn more about Save Foods Inc's (SVFD) stock grades for Value, Momentum and Growth and determine whether this Chemicals - Agricultural stock meets your. Discover real-time N2OFF, Inc. Common Stock (NITO) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Stock analysis for N2OFF Inc (SVFD:US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Looking to buy Save Foods Stock? View today's SVFD stock price, trade commission-free, and discuss SVFD stock updates with the investor community. Apple Stock Prediction. Sorry, SVFD is unavailable at this time. Powered by Financhill. Sign up; Blog. Save Foods (NASDAQ:SVFD) Shares Down % · info-gacor.site•6 months ago. Save Foods (NASDAQ:SVFD) Stock Price Down % - American Banking and Market News. Com Par $/Save Foods Inc (NASDAQ:SVFD) stock price quotes, company news, profile, dividends and competitors. Save Foods (SVFD) Stock Trends and Sentiment · Stock Analysis · Chart · Earnings · Financials · Headlines · Insider Trades · SEC Filings · Short Interest.

Unified Endpoint Management Gartner

Read the latest, in-depth Radia Unified Endpoint Management (Legacy) reviews from real users verified by Gartner Peer Insights, and choose your business. Gartner has recognized Microsoft as a Leader in the Magic Quadrant for Unified Endpoint Management info-gacor.site Gartner® Market Guide for Unified Endpoint Management Tools. Get the Ivanti is named a Leader and Outperformer for Unified Endpoint Management. Researchers pointed to unified endpoint security (UES) and unified endpoint management (UEM) as being among the major waves of the security future. The Gartner Magic Quadrant for Unified Endpoint Management has been published. Leaders listed included VMware, Microsoft, IBM, BlackBerry, Citrix and. Discover the top-rated Unified Endpoint Management (UEM) tools of with the Gartner Magic Quadrant report. Find out more here. Bengaluru, India, October 23, - 42Gears Mobility Systems, a Gartner Magic Quadrant VISIONARY for Unified Endpoint Management , is excited to be named. Microsoft is a Leader in the Gartner® Magic Quadrant™ for Unified Endpoint Management Tools Read the report: info-gacor.site Google Endpoint Management is a wonderful device management solution to simplify the solution of different devices within an organization. It has a very user-. Read the latest, in-depth Radia Unified Endpoint Management (Legacy) reviews from real users verified by Gartner Peer Insights, and choose your business. Gartner has recognized Microsoft as a Leader in the Magic Quadrant for Unified Endpoint Management info-gacor.site Gartner® Market Guide for Unified Endpoint Management Tools. Get the Ivanti is named a Leader and Outperformer for Unified Endpoint Management. Researchers pointed to unified endpoint security (UES) and unified endpoint management (UEM) as being among the major waves of the security future. The Gartner Magic Quadrant for Unified Endpoint Management has been published. Leaders listed included VMware, Microsoft, IBM, BlackBerry, Citrix and. Discover the top-rated Unified Endpoint Management (UEM) tools of with the Gartner Magic Quadrant report. Find out more here. Bengaluru, India, October 23, - 42Gears Mobility Systems, a Gartner Magic Quadrant VISIONARY for Unified Endpoint Management , is excited to be named. Microsoft is a Leader in the Gartner® Magic Quadrant™ for Unified Endpoint Management Tools Read the report: info-gacor.site Google Endpoint Management is a wonderful device management solution to simplify the solution of different devices within an organization. It has a very user-.

Microsoft emerges as a Leader in Gartner magic quadrant for Unified Endpoint Management (UEM)info-gacor.site Gartner report: Prepare for Unified Endpoint Management to Displace MDM and CMT. According to Gartner, “I&O leaders managing increasingly diverse endpoints. Matrix42's Secure Unified Endpoint Management (SUEM) integrates endpoint management and security as part of its Digital Workspace Platform offering. Unified endpoint management involves managing multiple endpoints using a single solution. UEM tools can manage multiple employees from one central platform. We're excited to offer you a complimentary copy of the Gartner® Market Guide for Unified Endpoint Management Tools, which we believe provides valuable. Unified endpoint management (UEM) is a class of software tools that provide a single management interface for mobile, PC and other devices. ManageEngine Endpoint Central Reviews. by ManageEngine in Unified Endpoint Management Tools. Ratings. The third iteration of the Gartner Magic Quadrant for Unified Endpoint Management (UEM) has arrived. Like I do every year. The global unified endpoint management market size was valued at USD billion in and is anticipated to grow at a compound annual growth rate (CAGR) of. We are thrilled to announce that HCL BigFix has been recognized in the Gartner Market Guide for Unified Endpoint Management Tools. Gartner. ManageEngine has been recognized as a Gartner® Peer Insights™ Customers' Choice in the Voice of the Customer for Unified Endpoint Management Tools BlackBerry Recognized as a Gartner® Peer Insights™ Customers' Choice for Unified Endpoint Management (UEM) Tools. May 14, For the second year. Unified endpoint management involves managing multiple endpoints using a single solution. UEM tools can manage multiple employees from one central platform. Unified Endpoint Management Tools, Peer Contributors, 7 May GARTNER is a registered trademark and service mark, and the GARTNER PEER INSIGHTS CUSTOMERS. Microsoft seen as leader by Gartner for Unified Endpoint Management Archived post. New comments cannot be posted and votes cannot be cast. Google Endpoint Management is a wonderful device management solution to simplify the solution of different devices within an organization. It has a very user-. Unified endpoint management (UEM) is a class of software tools that provide a single management interface for mobile, PC and other devices. Best Unified Endpoint Management (UEM) Software At A Glance ; Best for Small Businesses: NinjaOne ; Best for Mid-Market: JumpCloud ; Best for Enterprise. Known as Unified Endpoint Management (UEM), Gartner analyst Dan Wilson says UEM is entering the mainstream. It has achieved a market penetration of between 20%. ManageEngine Endpoint Central Reviews. by ManageEngine in Unified Endpoint Management Tools. Ratings.

Good Debt Bad Debt

Good debt vs. bad debt: What's the difference? · Debt can be good or bad—and part of that depends on how it's used. · Generally, debt used to help build wealth. Conversely, bad debt involves borrowing for non-appreciating assets. High-interest credit card debt is an example, as the interest rates can accumulate rapidly. Good Debt, Bad Debt concentrates on what you can do using your present income. It blends personal stories, research, history, and humor to build the argument. Good debt is investment debt that creates value. Medical education loans, real estate loans, home mortgages and business loans are all examples of good debt. Understanding good and bad debt · Good debt can help you build wealth as its value can grow. · Bad debt can leave you worse off in the long run with purchases. Good debt is often used to acquire income-producing assets or those that will increase in value over time. You'll often find that these debts come with. Good debt allows you to manage your finances more effectively, to leverage your wealth, to buy things you need and to handle unforeseen emergencies. Examples of. Good debt is debt you undertake for a specific purpose with a clear timeline for repayment, whether it's a year-mortgage or a $3, credit card charge you. Good debt is really anything that is spent on items that can appreciate or increase in value (like mortgages on homes and education loans). But. Good debt vs. bad debt: What's the difference? · Debt can be good or bad—and part of that depends on how it's used. · Generally, debt used to help build wealth. Conversely, bad debt involves borrowing for non-appreciating assets. High-interest credit card debt is an example, as the interest rates can accumulate rapidly. Good Debt, Bad Debt concentrates on what you can do using your present income. It blends personal stories, research, history, and humor to build the argument. Good debt is investment debt that creates value. Medical education loans, real estate loans, home mortgages and business loans are all examples of good debt. Understanding good and bad debt · Good debt can help you build wealth as its value can grow. · Bad debt can leave you worse off in the long run with purchases. Good debt is often used to acquire income-producing assets or those that will increase in value over time. You'll often find that these debts come with. Good debt allows you to manage your finances more effectively, to leverage your wealth, to buy things you need and to handle unforeseen emergencies. Examples of. Good debt is debt you undertake for a specific purpose with a clear timeline for repayment, whether it's a year-mortgage or a $3, credit card charge you. Good debt is really anything that is spent on items that can appreciate or increase in value (like mortgages on homes and education loans). But.

What is good debt? Some debt may be a smart investment in your financial future if utilized wisely and you can afford it. It's geared toward leaving you in. What separates good and bad debt? Good debt can help you achieve long-term financial goals while bad debt serves an immediate need that does not increase in. Debts can be good or bad, depending on how they impact you in the long run. Good debts usually improve your credit score, which allows you to take on more. Debt falls into two main categories – good or bad. Here are some differences between them. Think of good debt as something long-term that. Good debt is generally considered any debt that may help you increase your net worth or generate future income. Importantly, it typically has a low interest or. Taking on debt to make unnecessary purchases, for example using a credit card to fund a holiday, is what might be considered a bad debt. This kind of purchase. Debt that can work against you · High interest rates will cost you over time. Credit cards are convenient and can be helpful as long as you pay them off every. Choosing the Right Debt. Beyond good and bad is the question of whether any debt is right for you. The easiest way to answer that question is by determining. Credit Card Debt. Owing money to your credit card is one of the most common types of bad debt. Credit cards are issued by lenders and allow you to make. A bad debt is money you borrow that leads to more financial problems or obstacles for you in the future. High-interest consumer debt is considered bad debt. Distinguishing Good Debt from Bad Debt. When we talk about “good debt”, it usually refers to debt that was taken on to help advance your future income or. Borrowing to invest in a small business is generally considered “good debt" if it helps you make more money and build a successful business. Much like borrowing. Extreme Debt. When you defer payment and obtain credit, you end up with a debt. "Good debt" is one that can make you better off financially in the long run. ". Understanding the difference between good debt vs bad debt is key to sound financial management. Good debt like mortgages builds assets and income while bad. Good debt is where customers buy your services but make regular, consistent repayments in line with their agreement with your business. Examples of good debt. Beginners Guide to Good and Bad Debt · Personal loans or home equity loans used to improve the condition of a home may also increase its value, and in such. On the other hand, bad debt is typically higher interest debt, not backed by a value increasing asset (automobile, credit cards), unplanned within your budget. Generally, good debt will pay you over time, regardless of the interest. Good debt is also something that you can write off in taxes. Bad debt. If you buy something that immediately goes down in value, that's bad debt. Let's say you buy disposable items or durable goods with a high-interest credit card.

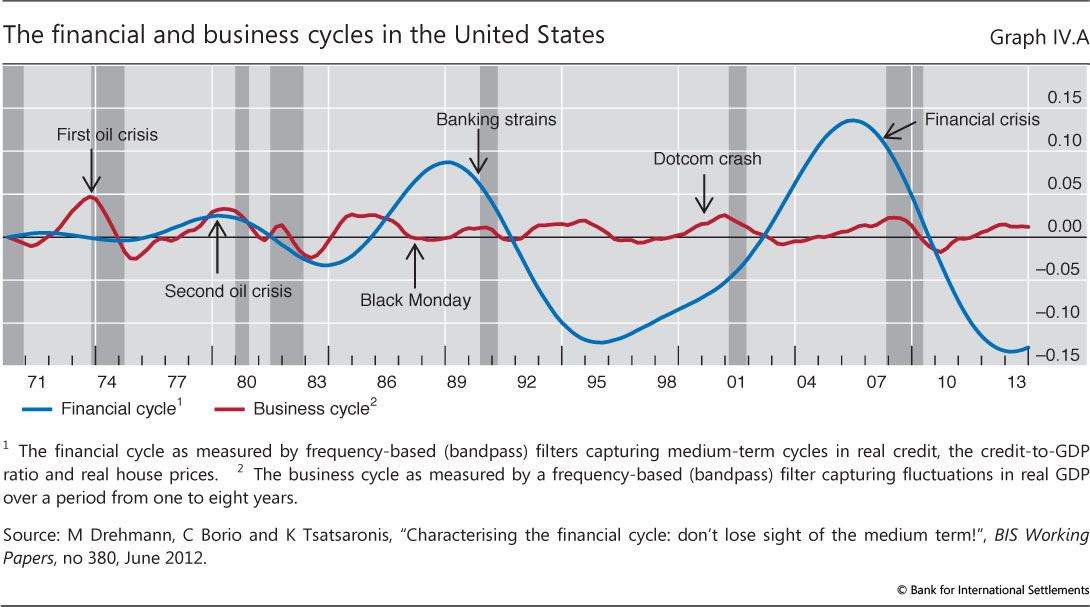

Financial Cycle

But is there a financial cycle at all? And if so, how has its operation in the global economy evolved? The first goal of this paper is to fill some gaps in our. Since the s, the financial indicators such as asset prices, credit growth, bank leverage ratio, and crossborder capital flows have resonated with each. Business cycles are intervals of general expansion followed by recession in economic performance. The changes in economic activity that characterize. Financial Cycle Time (FCT) measures just that — the average time it takes a company to turn an investment into revenue. The metric is measured in days — the. The data collection cycle opens August 7, The surveys financial assistance program authorized by Title IV of the Higher Education. Here's the game plan: Single: Separate your savings goals. Get started by divvying up your savings accounts to match your financial goals. Third Quarter Global business cycle in prolonged expansion. Major economies demonstrated persistent expansion amid improved global financial conditions. We conclude that the growing role of ETFs as a channel for international capital flows amplifies the global financial cycle in emerging markets. Keywords. Guide to Financial Operations · II. New York State Financial Accounting; II.3 New York State Financial Cycle. II. New York State Financial Accounting. Guide to. But is there a financial cycle at all? And if so, how has its operation in the global economy evolved? The first goal of this paper is to fill some gaps in our. Since the s, the financial indicators such as asset prices, credit growth, bank leverage ratio, and crossborder capital flows have resonated with each. Business cycles are intervals of general expansion followed by recession in economic performance. The changes in economic activity that characterize. Financial Cycle Time (FCT) measures just that — the average time it takes a company to turn an investment into revenue. The metric is measured in days — the. The data collection cycle opens August 7, The surveys financial assistance program authorized by Title IV of the Higher Education. Here's the game plan: Single: Separate your savings goals. Get started by divvying up your savings accounts to match your financial goals. Third Quarter Global business cycle in prolonged expansion. Major economies demonstrated persistent expansion amid improved global financial conditions. We conclude that the growing role of ETFs as a channel for international capital flows amplifies the global financial cycle in emerging markets. Keywords. Guide to Financial Operations · II. New York State Financial Accounting; II.3 New York State Financial Cycle. II. New York State Financial Accounting. Guide to.

Guide to Financial Operations · II. New York State Financial Accounting; II.3 New York State Financial Cycle. II. New York State Financial Accounting. Guide to. Gross capital flows, common factors, and the global financial cycle (English). Loading. DETAILS. See More. SUBSCRIBE TO EMAIL ALERTS. The Bank for International Settlements Looks Through the Financial Cycle. By Perry G. Mehrling. Jun 28, | Finance | Government & Politics | History. cycle of development, boosting growth, improving productivity, and reducing poverty. In EMDEs, however, investment growth has seen a sust See More. A. Expansions are times of increasing profits for businesses, and rising economic output, and are the phase the U.S. economy spends the most time in. Contractions. This figure shows the timeline of the parliamentary financial cycle with the changes incorporated for the remainder of the 42nd Parliament. But is there a financial cycle at all? And if so, how has its operation in the global economy evolved? The first goal of this paper is to fill some gaps in our. What is the link between the financial cycle – financial booms, followed by busts – and the real economy? What is the direction of this link and how salient. and at international level. Global financial cycles (global factor in risky asset prices). ▫ Rey (): Dilemma not trilemma: the global cycle and. Principal Federal Economic Indicators ; Gross Domestic Product. Q2 (Adv). +% ; Personal Income. June +% ; International Trade in Goods and. We begin by estimating the global financial cycle at a weekly frequency with data through and observe the two standard deviation fall in our global. The authors of this study argue that the growth rate of aggregate balance sheets may be the most fitting measure of liquidity in a market-based financial system. It also examines the drivers of capital flows in crisis and non-crisis periods and the role of the global financial cycle. Unit 1: What is Financial. This paper provides a tractable framework for the joint explanation of the Global Financial Cycle and Global Imbalances. I show, both theoretically and. What does an effective annual financial cycle look like? 1. External reporting. Forecasting. Internal tracking/reportin g. Budgeting. Annual financial process. The financial cycle is the annual process through which Parliament: The image shows the interdependence of the executive and legislative branches with respect. The short-term political cycle moves loosely in sync with the short-term credit/debt/market/economic cycle. As for where these cycles are headed. Financial Cycle Time (FCT) expresses the one thing that the world's best disruptors have in common: the ability to turn invested capital into profit at. 12 - Financial Cycles and Fiscal Cycles · where FISCAL it is the fiscal variable of interest of country i in time t and the CYCLE it variable captures the.

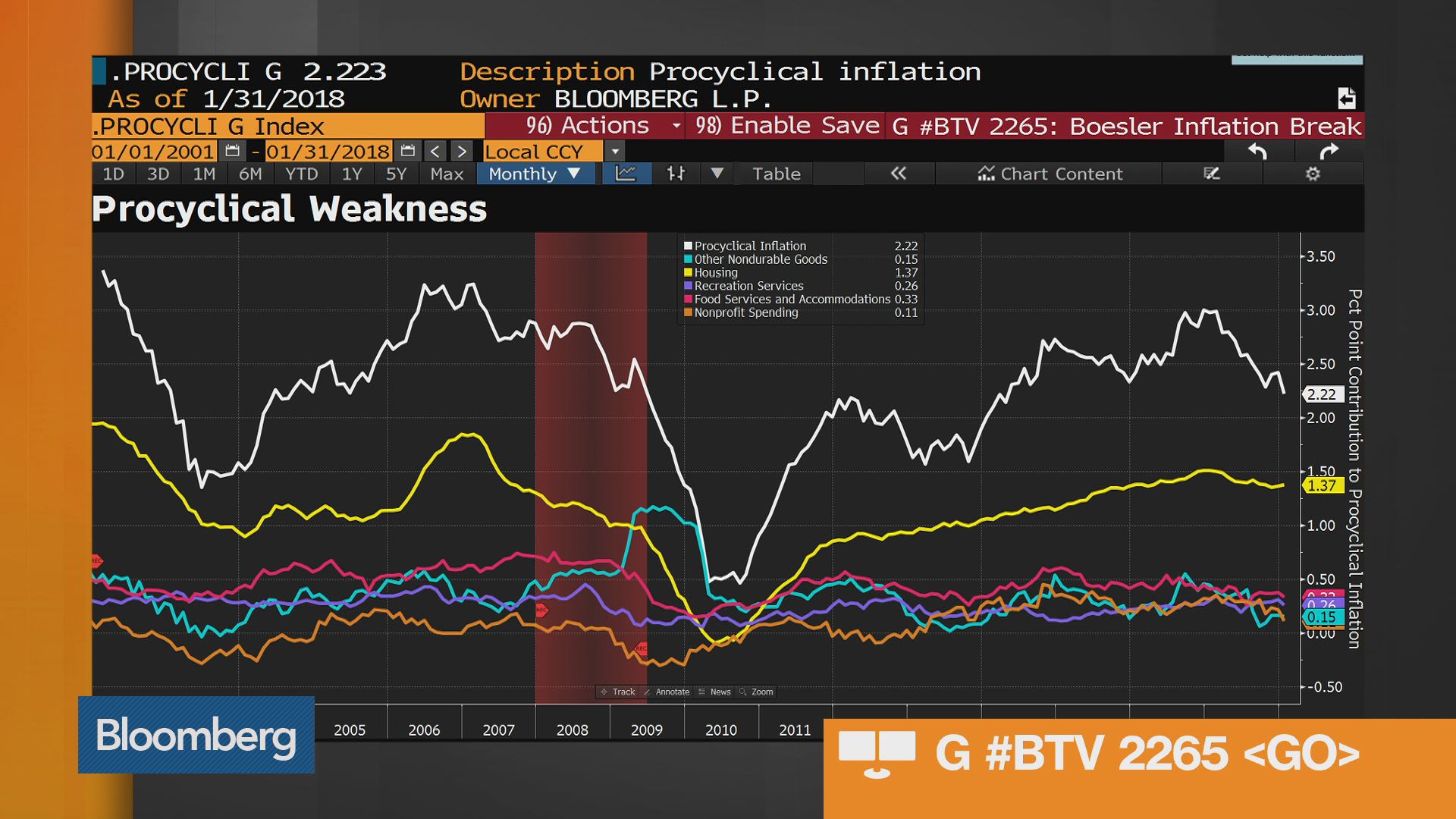

What Do You Invest In When Inflation Rises

One excellent inflation investment strategy that you can take advantage of in is to invest in I Bonds. These U.S. savings bonds earn interest based on a. Correspondingly, the value of real assets such as stocks, real estate, and commodities such as gold will increase in value. Gol. Continue Reading. Equity REITs (real-estate investment trusts) may also help mitigate the impact of rising inflation. They outperformed inflation 66% of the time and posted an. Invest for growth and rebalance regularly. “In response to higher inflation and interest rate increases by the Federal Reserve, bond yields have become. For example, while you're planning your retirement fund, you can keep up with rising inflation by adding money to your savings account each month. But, once you. So by definition, they generally have performed well when inflation rises. Equity REITs (real-estate investment trusts) may also help mitigate the impact of. In an inflationary environment the assets that are likely to do best include. Short term debt like treasuries, TIPS, Floating Rate Assets. Another asset that tends to appreciate in value during inflationary times is oil. You can get exposure by buying the physical stock but not actual barrels of. Adding certain asset classes, such as commodities or real estate, to a well-diversified portfolio of stocks and bonds can help buffer against inflation. One excellent inflation investment strategy that you can take advantage of in is to invest in I Bonds. These U.S. savings bonds earn interest based on a. Correspondingly, the value of real assets such as stocks, real estate, and commodities such as gold will increase in value. Gol. Continue Reading. Equity REITs (real-estate investment trusts) may also help mitigate the impact of rising inflation. They outperformed inflation 66% of the time and posted an. Invest for growth and rebalance regularly. “In response to higher inflation and interest rate increases by the Federal Reserve, bond yields have become. For example, while you're planning your retirement fund, you can keep up with rising inflation by adding money to your savings account each month. But, once you. So by definition, they generally have performed well when inflation rises. Equity REITs (real-estate investment trusts) may also help mitigate the impact of. In an inflationary environment the assets that are likely to do best include. Short term debt like treasuries, TIPS, Floating Rate Assets. Another asset that tends to appreciate in value during inflationary times is oil. You can get exposure by buying the physical stock but not actual barrels of. Adding certain asset classes, such as commodities or real estate, to a well-diversified portfolio of stocks and bonds can help buffer against inflation.

As savings held in cash will tend to lose value because inflation reduces their buying power over time, investing can help to protect the value of your money as. By investing in equity funds, you can benefit from the capital growth of the underlying companies, as well as any dividend income. It's important to remember. What is inflation and why should I be concerned about it? · The Rising Cost of a Dollar · What are TIPS? · How TIPS can Grow in Value · What are the benefits of. 7 Stocks That Are Good Inflation Investments ; Stock, Implied upside over May 9 closing price ; Mosaic Co. (ticker: MOS), % ; APA Corp. (APA), % ; Applied. A hedge against inflation includes assets that often outperform during inflationary times. Read how gold, real estate, and bonds are inflation hedges. As savings held in cash will tend to lose value because inflation reduces their buying power over time, investing can help to protect the value of your money as. Another item to consider is taking out a long-term loan with a locked in interest rate, considering agricultural loans and leasing options can also be a. Should I Invest During Inflation? · TIPS · Cash · Short-term bonds · Stocks · Real estate · Gold · Commodities · Cryptocurrency. Real estate generally does a good job of keeping up with inflation, and you can add commercial real estate exposure to your portfolio through the stock market. Smart investing may allow your money to outpace inflation and increase in value. you've invested, or the investment's overall increase in value. Investing in. In times of inflation, prices increase and the value of currency decreases. · Keep the money you set aside for the future in an account that earns interest. Investments that pay a floating rate of return are likely to be better off in an inflationary environment, as the interest rate they pay is adjusted. The best way to mitigate the risk of rising inflation is to have a well diversified portfolio. If you're investing for the long term, your portfolio should have. Commodities are known to perform well because inflation tends to boost their prices. Similarly, real estate investment trusts (REITs) may benefit when inflation. When rising inflation is a concern, having investments with an income component can help offer some peace of mind. Choosing interest- or dividend-paying. Treasury inflation protected securities are a popular option. Treasury inflation protected securities (TIPS) are fixed income investments that rise in tandem. Inflation is a sustained increase in prices of goods and services, which can negatively impact purchasing power and lead to tough financial decisions for. When investing in shares, you take direct ownership of the shares rather than just speculating on prices. This means that you'll profit from your investment if. Make inflation-proof investments. Investing can be another way to beat rising prices, if the returns you make on the stock market, for example, are higher than. A conservative, income-producing portfolio yielding 5% will still keep you ahead of inflation when inflation rates are the target 2%. But when inflation rises.

How Much Does It Cost To Add A Swimming Pool

On average, an in-ground swimming pool costs between $35, and $65, With customization and special features, the overall expenses can reach upwards of. Installing pools requires expertise in excavation, dirt disposal, equipment use, and landscaping. · The average cost to install an in-ground pool ranges from. The average cost to install an inground pool in is between $80, and $, The pool itself is less than that, but by the time you add stone, concrete. General Cost Estimates by Pool Type · Vinyl Liner: $30,+ · Concrete/gunite – $40, to $45,+ · Fiberglass – 45,+. While the price of a DIY in-ground kit starts at around $10,, excluding installation costs which include pouring a concrete floor, once again you need to. A pool is a great addition to any home but makes more sense if you live in a warmer climate and a posh neighborhood. The average cost of installing a pool is. The national average of installing an inground pool is $35, Inground pool installation costs will also be determined by the material that you choose. In the. The average in-ground pool installation costs $35, for a pool with average pool dimensions of 10 to 20 feet wide by 20 to 40 feet long, with a capacity. If you are a beginner, saltwater swimming pool installation costs around $29, to $ and $ to $ if you already have a chlorine pool. Conversion of. On average, an in-ground swimming pool costs between $35, and $65, With customization and special features, the overall expenses can reach upwards of. Installing pools requires expertise in excavation, dirt disposal, equipment use, and landscaping. · The average cost to install an in-ground pool ranges from. The average cost to install an inground pool in is between $80, and $, The pool itself is less than that, but by the time you add stone, concrete. General Cost Estimates by Pool Type · Vinyl Liner: $30,+ · Concrete/gunite – $40, to $45,+ · Fiberglass – 45,+. While the price of a DIY in-ground kit starts at around $10,, excluding installation costs which include pouring a concrete floor, once again you need to. A pool is a great addition to any home but makes more sense if you live in a warmer climate and a posh neighborhood. The average cost of installing a pool is. The national average of installing an inground pool is $35, Inground pool installation costs will also be determined by the material that you choose. In the. The average in-ground pool installation costs $35, for a pool with average pool dimensions of 10 to 20 feet wide by 20 to 40 feet long, with a capacity. If you are a beginner, saltwater swimming pool installation costs around $29, to $ and $ to $ if you already have a chlorine pool. Conversion of.

Due to its massive size, an Olympic-size pool costs from $, to $M. Indoor pool. Swimming when there's snow on the ground? Of course! With an indoor. Total cost · From $1, to $15, for an above-ground swimming pool · From $23, to $40, gets you an infinity pool. · Pricing for a lap pool ranges from. The starting cost of an inground pool depends on its type. The cost of a concrete in ground pool typically starts from $65,, but it offers an endless amount. On average, the cost to build a custom inground pool in Orange County ranges between $80, to $, However, it's worth noting that these figures are. On average, the cost to build a pool will range anywhere from $30, to $,+. It's all about what you're wanting to get and how much you can affordably. A dealer familiar with the local rules and your site can provide a tight quote, but for general guidelines, you can use a figure of $1, per linear foot (pool. The cost is much the same as adding a new room to your home or any other major home improvement project. Just as the cost for a room addition or a remodeling. I'd stay away from fiberglass and vinyl pools as well. $k for a gunite pool is about right depending on your material and equipment. The national average cost for installing an in-ground concrete pool ranges between $60, and $, The average cost to build a 12' x 24' in-ground. The average cost to install an indoor swimming pool is about $ (Building a 12' x 24 indoor in-ground fiberglass indoor pool with concrete decking). According to HomeGuide, inground pools in Florida cost between $28, and $, The average cost is between $35, and $60, depending on the type of. On average, an in-ground swimming pool costs between $35, and $65, With customization and special features, the overall expenses can reach upwards of. Fiberglass Pool Costs Per Size · Small fiberglass pools – sized from 10′ x 20′ up to about 13′ x 27′ = $70, – $75, · Medium fiberglass pools – sized. General Cost Estimates by Pool Type · Vinyl Liner: $30,+ · Concrete/gunite – $40, to $45,+ · Fiberglass – 45,+. So take your time when selecting materials for your swimming pool, spa, deck, and any other features you're installing. It is a good idea to do research on. The installation costs of above ground pools usually run $$3,, depending on the size and type of pool. Keep in mind that oval pools normally cost more to. On average, inground swimming pools cost anywhere from $50 to $ per square foot to install, and that's without any upgrades. There are also other add-ons to. Try some of our free swimming classes. Babies or toddlers can put on swim diapers before they head into the water. While we may be able to find a place to park. The Starting Cost To Install An Inground Pool. For a vinyl-lined pool, the basic project cost is between $50, and $75, and includes the pool, a basic. Could range anywhere from 25k-over k for just the pool.

How To Finance A Tractor Trailer

Financing offers a first-time semi-truck buyer program to help you get started in the industry. Contact us now for commercial truck financing options! If you're new to the industry getting a commercial loan on a truck can be difficult without serious cash behind you. Then you have to decide. Bank of America offers an interest rate of %, the lowest on our list, making it a good option when looking for semi-truck financing. Keep in mind that. Alberta truck Lease provides trailer loans, truck loans and heavy equipment leasing and financing options. Call NOW at Loans for eighteen-wheelers for first-time owner operators and startup trucking companies are offered by every company on the list below. We have options for new and used commercial trucks, as well as used semi trucks with no age or mileage restrictions. Apply or contact us today to discuss your. The amount of your down payment could be 10%%. For example, if you take out an $80, loan for commercial dump truck financing with 15% down, you'll need a. We offer commercial truck loans for all commercial vehicles: semi trucks, big rigs, tractor trailers, car haulers, box trucks, platform trucks, dump trucks. The most important qualifications for semi-truck financing include overall credit, down payment, time with CDL license, and the age of the truck. Financing offers a first-time semi-truck buyer program to help you get started in the industry. Contact us now for commercial truck financing options! If you're new to the industry getting a commercial loan on a truck can be difficult without serious cash behind you. Then you have to decide. Bank of America offers an interest rate of %, the lowest on our list, making it a good option when looking for semi-truck financing. Keep in mind that. Alberta truck Lease provides trailer loans, truck loans and heavy equipment leasing and financing options. Call NOW at Loans for eighteen-wheelers for first-time owner operators and startup trucking companies are offered by every company on the list below. We have options for new and used commercial trucks, as well as used semi trucks with no age or mileage restrictions. Apply or contact us today to discuss your. The amount of your down payment could be 10%%. For example, if you take out an $80, loan for commercial dump truck financing with 15% down, you'll need a. We offer commercial truck loans for all commercial vehicles: semi trucks, big rigs, tractor trailers, car haulers, box trucks, platform trucks, dump trucks. The most important qualifications for semi-truck financing include overall credit, down payment, time with CDL license, and the age of the truck.

Get easy, guaranteed semi truck loans with affordable loan rates and finance terms. Financing for 18 wheelers, truck repair, bad credit are also available. Semi-Truck Fleet Financing · 0% To 30% Down Payment · Minimum FICO Credit Score · + PayNet Score · Minimum 2 Years In Business. Patron West specializes in commercial equipment financing to get you the best deals for lease financing the purchase of semi trucks. The House of Trucks offers a flexible financing program to finance your purchase of a used semi-truck or trailer. Contact us to learn more. How much money do I need to put down as a down payment? The industry standard is 10% of the purchase price. The finance manager will work with you and your. National Truck Loans offers simple and quick truck repair financing for major repairs costing $15, and above, to help you get back on track as soon as. TopMark Funding is the nation's top-rated semi-truck lender. We have several competitive semi-truck funding programs to get you the monthly payment you want. Truck Capital extends commercial truck financing to borrowers with both good and bad credit. Eligible borrowers can utilize Truck Capital loans to acquire new. Mission Financial can work with you to secure your first time buyer loan in all 48 continental states as a direct lender. We also work with major dealerships. This guide answers the most common questions customers ask about financing a heavy duty truck and trailer—and also includes questions they should be asking. Most semi truck financing requires you to make a down payment. This varies from –10% down on average. Some options allow borrowers to save money on fees/. We have a tractor-trailer financing solution for you and your trucking business. We have the best tractor-trailer leasing and loan programs that will fit your. CAG Truck Capital has been considered the best semi-truck financing company for owner-operators with any credit bad to great and everything in between. Selfreliance Federal Credit Union offers Truck Loans with low, fixed interest rates with flexible terms. Traditional truck loans typically require your credit, business revenue, and time in business to determine if you're qualified. CAG Truck Capital has been considered the best semi-truck financing company for owner-operators with any credit bad to great and everything in between. This guide will cover the best commercial truck lenders, help you determine the best type of loan, and how to apply. Truck Capital extends commercial truck financing to borrowers with both good and bad credit. Eligible borrowers can utilize Truck Capital loans to acquire new. To finance a tractor or trailer, select the dealership and vehicle you'd like, then talk to a First Citizens representative at your local branch, Opens in a new. We are an experienced semi truck loan company that offers financial support, guidance for the truck purchasing process, and truck sellers.

Swing Trading Groups

Community. The Swing Trading Club is a group of people from all walks of life who all have the common goal of making money in the stock market. Swing Trading Channel: Live swing trading – trades a week – ideal for You can be a member of both groups. TraderTom Live Day Trading Channel. Meet other local people interested in Swing Traders: share experiences, inspire and encourage each other! Join a Swing Traders group. 15, members. Alpha-X Trading Group: A Guide To Forex Swing Trading [Hardman, Daniel] on info-gacor.site *FREE* shipping on qualifying offers. Alpha-X Trading Group: A Guide. Swing trading is a style that is longer than day trades but not more than a couple of months. Day trading buys and sells the same day, while position trading. Swing trading is a popular trading strategy designed to take advantage of price movements or 'swings' in the markets. Swing traders look to buy or sell an. Discuss swing trading of stocks, forex, and futures. Swing trading is taking trades that last a day or longer, up to several months. Key Takeaways · Swing trading involves taking trades that last a couple of days up to several months in order to profit from an anticipated price move. · Swing. How Swing Trading Works. Swing traders typically trade stocks per week, providing a secondary income for those will full time jobs. Community. The Swing Trading Club is a group of people from all walks of life who all have the common goal of making money in the stock market. Swing Trading Channel: Live swing trading – trades a week – ideal for You can be a member of both groups. TraderTom Live Day Trading Channel. Meet other local people interested in Swing Traders: share experiences, inspire and encourage each other! Join a Swing Traders group. 15, members. Alpha-X Trading Group: A Guide To Forex Swing Trading [Hardman, Daniel] on info-gacor.site *FREE* shipping on qualifying offers. Alpha-X Trading Group: A Guide. Swing trading is a style that is longer than day trades but not more than a couple of months. Day trading buys and sells the same day, while position trading. Swing trading is a popular trading strategy designed to take advantage of price movements or 'swings' in the markets. Swing traders look to buy or sell an. Discuss swing trading of stocks, forex, and futures. Swing trading is taking trades that last a day or longer, up to several months. Key Takeaways · Swing trading involves taking trades that last a couple of days up to several months in order to profit from an anticipated price move. · Swing. How Swing Trading Works. Swing traders typically trade stocks per week, providing a secondary income for those will full time jobs.

Infirix | Software · ZTRADEZ (OPTIONS & STOCKS) · E³ Trading Group · SweatNation · Daily Grind Trading · UpRise Traders · REDWOOD Alerts & Indicators · Trading With. Looking for swing trading stocks? Benzinga is here to inspire you with a few stocks that are perfect for swing trading. Swing trading is a strategy aimed at capturing short to medium-term gains over a few days to several weeks in the forex market, and it relies. Swing Trading relies on short-term moves in stocks to build profits. Unlike day trading, where buys and sells occur on the same day, swing trades last for a. Join the ranks of over 70, winning traders who have been kicking butt and taking names with our simple swing trading strategy—since Swing trading is all about identifying short-term price movements and taking advantage of them, especially when using trade alerts and trade. The Day Trading Chatroom Website is designed for the Active Trader and Day Trader. Join a community of professional and intelligent day trading group that hold. Active traders often group themselves into two camps: day traders or swing traders. Both seek to profit from short-term stock movements as opposed to. This guide covers an example that illustrates how to swing trade stocks using a Fibonacci retracement and helps you to identify your swing trading entry and. Active traders often group themselves into two camps: day traders or swing traders. Both seek to profit from short-term stock movements as opposed to. The Swing Trading Coaching Group is designed to give you the System, Software and Support you need to swing trade with confidence and success. Swing trading refers to the practice of trying to profit from market swings of a minimum of 1 day and as long as several weeks. Swing trading is the sweet spot between position and day trading. It relies on quick trades (most fall within a 5- to day timeframe) and smaller profit. Swing trading is a popular trading style used by traders aiming to profit from short to medium-term price movements. Best Swing Trading Stocks List – High Relative Strength. Here is the current Best Swing Trading Stocks list based on a strong UPTREND in recent months. There. The Precision Swing Trading course combines theory with practical application, so that you'll know the exact set-up, entry and exit for every trade. Top courses in Swing Trading and Stock Trading · Fibonacci Technical Analysis Skill for Forex & Stock Trading · Swing Trading Ninja: 12 Hour Complete Swing. Designed for both beginners and seasoned traders, TTG offers comprehensive resources to help you understand and capitalize on market swings effectively. The Wagner Daily PRO is the premier stock picking service for busy professionals. Our team of experienced traders constantly scours the markets to identify the. Swing trading is a popular trading strategy designed to take advantage of price movements or 'swings' in the markets. Swing traders look to buy or sell an.